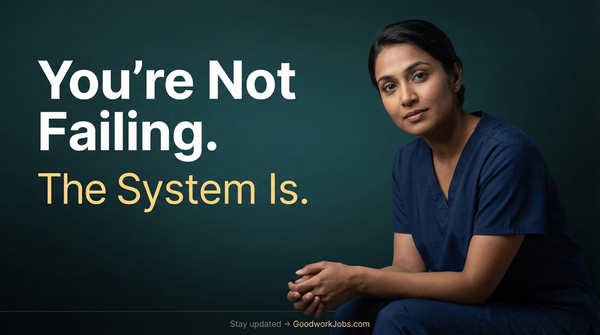

What Nurses Need to Know About the Federal Student Debt Loan Relief Program

The President revealed a plan to alleviate student loan debt, which will impact nurses at all levels of education and experience. This initiative reduces monthly payments by half for low-income borrowers, acknowledges relevant work experience for repayment credits, aims to decrease college costs in the long run, and offers targeted debt assistance for those with low to middle incomes. Nurses earning less than $125,000 individually, or a household income below $250,000, are eligible for up to $20,000 in debt cancellation as part of this three-part initiative in partnership with the Department of Education.

Nurses earning under $125,000 will benefit from this targeted student debt relief program. To find out if you qualify for the debt cancellation, you must have one of the following loan types: Direct subsidized or unsubsidized federal student loans, Parent Plus Loans, Direct Stafford Loans, or Grad Loans. Your annual income should be under $125,000 for individuals or $250,000 for married couples or heads of households. If you received a Pell Grant while in college and meet the income thresholds, you could qualify for up to $20,000 in cancellation; without a Pell Grant, you may qualify for up to $10,000. Dependent students will have their eligibility based on their parents’ financial situation. If you meet the qualifications for relief, the amount canceled cannot exceed your outstanding debt. For example, if eligible for $20,000 in forgiveness but only owe $13,000, you'll receive $13,000 in debt relief.

Steps for nurses to claim student loan relief: This debt cancellation can vastly benefit many nurses, whether they are currently studying or have been carrying student debt for a significant time. To acquire this relief, the Department of Education has set up a subscription page to notify borrowers when the application process starts. Simply input your email and select the option for “Federal Student Loan Borrower Updates.” Relief will be automatic for those for whom income information is already available. If you're unsure whether your income data is on file, an application will be available in the upcoming weeks, and email alerts will inform you when it opens. The pause on federal student loan payments is expected to continue through the end of the year, and applications should be available prior to that pause lifting.

Not every nurse will qualify for the federal student loan forgiveness initiative. While it’s predicted that many will benefit, some loans do not meet eligibility criteria. Fortunately, several other loan forgiveness options exist for nurses, including: The Nurse Corps Loan Repayment Program, which can cover up to 85% of unpaid nursing education in exchange for three years of work in underserved regions; the Public Service Loan Forgiveness Program that grants forgiveness after 120 non-consecutive payments for working full-time at government or nonprofit agencies; the Federal Perkins loan cancellation available for full-time nurses who have previously taken Perkins loans; military loan forgiveness for those who have served in the Army, Navy, or Air Force; and various state loan forgiveness programs designed for nurses in high-demand areas.

Next steps: If you’re a nurse with a student loan eligible for federal forgiveness and your income is under $125,000, register right away to get updates from the Department of Education. You won’t need to prove your eligibility since they already have the necessary loan information. If unsure whether your current income data is on record, complete the application when it is made available. When the debt forgiveness program is initiated, your new loan balance and payment structure will be adjusted accordingly.