The Best Home Buying Programs for Healthcare Professionals

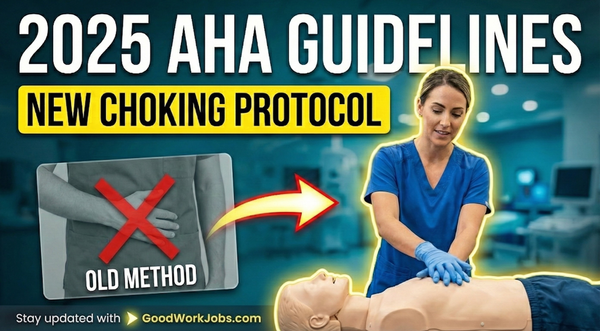

Nursing holds a prestigious place among professions, and the need for skilled registered nurses is so great that they can secure high-paying positions nearly anywhere they choose. Despite this, some financial institutions may regard nurses as credit risks when considering them for loans. While this seems counterproductive given their substantial salaries, it does occur. The frustration is understandable, particularly when nurses dedicate so much effort to caring for others and managing significant responsibilities. Fortunately, when it comes to home purchasing, nurses have alternatives, including programs tailored for healthcare workers. This article examines: Common mortgages available to nurses, Specialized loans for nurses, Private lender options, Homebuying grants for nurses, Navigating homeownership hurdles.

Common mortgages available to nurses: Nurses might face challenges in obtaining a mortgage, but it isn't a universal issue, and there’s no necessity for them to only pursue nursing-specific mortgage programs. Various affordable options are widely available. Popular choices include: Conventional mortgages, which are not government-backed but adhere to guidelines set by government-sponsored entities. Eligibility typically requires a minimum 3% down payment and a credit score of 620 or above. FHA loans are attractive to nurses with credit scores between 580 and 620, though some lenders may demand higher scores. Backed by the Federal Housing Administration, these loans come with conditions, such as a 3.5% down payment and mandatory private mortgage insurance (PMI) when putting down less than 20%. PMI shields the lender, not the borrower. VA loans, offered by the U.S. Department of Veteran Affairs, are available to military-serving nurses. These loans are appealing as they require no down payment to secure favorable rates and closing costs, and they exempt borrowers from PMI. Lenders set their own credit score requirements, generally between 580 and 660. USDA loans are another option, backed by the U.S. Department of Agriculture, requiring no down payment for optimal rates. Eligibility demands a credit score of at least 640 and meeting income limits, with a commitment to rural home purchases. Nurses can verify eligible areas through USDA maps.

Specialized loans for nurses: Two notable national programs specialize in loans for nurses. Nurse Next Door is not a direct lender but an assistance program linking nurses to financial aid, mortgages, and properties. It also offers a Fresh Start Program to help nurses with credit issues prepare for mortgage applications and provides down payment assistance for those who qualify. Homes for Heroes aids nurses and other healthcare workers in buying, selling, or refinancing homes with affiliate real estate and mortgage brokers. Nurses can save an average of $2,400, with additional savings from using program-referred specialists.

Private lender options: Nurses can find favorable deals from private mortgage lenders offering perks like reduced closing costs. Mortgages for Champions by RealFi Home Funding Corp., a licensed direct lender in several states, allows nurses to save 2-3% by avoiding typical closing fees.

Homebuying grants for nurses: Besides the Nurse Next Door grants, numerous down payment assistance programs cater to nurses. Checking your state’s Housing and Urban Development (HUD) website is a good way to find local programs, although eligibility varies widely.

Navigating homeownership hurdles: Nurses may encounter unique challenges when securing mortgages. Lenders assess eligibility based on income and creditworthiness, but a lack of understanding about nursing roles can lead to denial of needed financial resources. To counteract this, nurses should reduce debt before applying, making them more appealing to banks. Challenges include: Travel nurse income, which can confuse lenders due to varying hours and pay rates. A letter from a current employer confirming employment terms can help. Student debt is another factor influencing mortgage approvals, as nurses often pursue advanced education. Engaging with loan specialty programs can lower debt-to-income ratios, boosting mortgage qualification chances. Seeking a new position? Check our Nursing Jobs Board for openings in your specialty.